ELSS stands out as one of the best tax planning tools for 3 reasons:

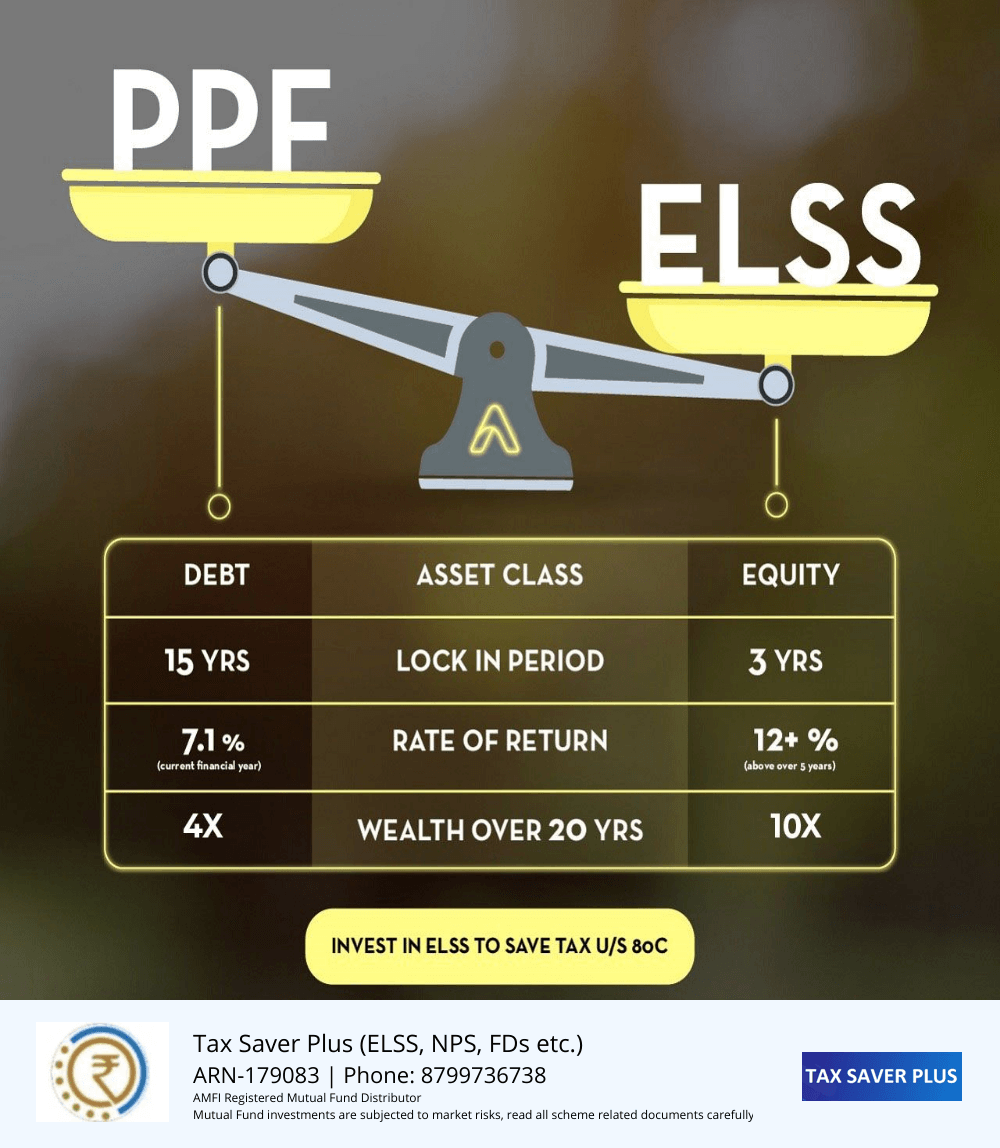

1.Minimal Lock-in Period: Unlike other options such as 5-year Fixed Deposits (FDs), NSC, insurance, or PPF, ELSS has the shortest lock-in duration of just 3 years

2.Convenient SIP Initiation: ELSS simplifies the process of initiating a SIP, making it an easily accessible investment avenue. It can be weekly, monthly, quarterly or even yearly

3.Impressive Track Record: Let’s take an example: if you invested ₹1,00,000 every year in PPF since August 2009, your total investment of ₹15 lakhs has grown to ₹27 lakhs. Now, compare that to investing the same ₹15 lakhs in any ELSS scheme, where the returns have ranged from ₹38 to ₹63 lakhs. Even the lowest return in ELSS is 40% higher than the PPFs, and on average, ELSS has delivered 62% higher returns. The investment values are as of Aug 2023.

Login/Register on www.taxsaverplus.in to download the app.