Why Settle For Less? | Tax Saver Plus Ready to maximize your wealth potential? Discover how investing in ELSS can help you build wealth and save up to Rs.46,800 in taxes. See how you can save tax up to Rs. 85,800 this financial year Login/Register on www.taxsaverplus.in to download the app.

ELSS

Enjoy the dual benefit of tax saving and wealth creation with the only tax-saving mutual fund: ELSS Start your ELSS this financial year. Login/Register on www.taxsaverplus.in to download the app.

This tax-planning season, don’t just save taxes but also build your wealth with ELSS The Save, Invest, Protect ‘SIP’ strategy helps you empower your wealth with smart financial choices. Save taxes up to Rs. 85,800 this financial year. Login/Register on www.taxsaverplus.in to download the app.

Do you know? ELSS is the only tax-saving mutual fund scheme that helps you to save tax and build wealth. This tax season, make sure you optimize your tax-saving opportunities with ELSS. Save taxes up to Rs. 85,800 this financial year. Login/Register on www.taxsaverplus.in to download the app.

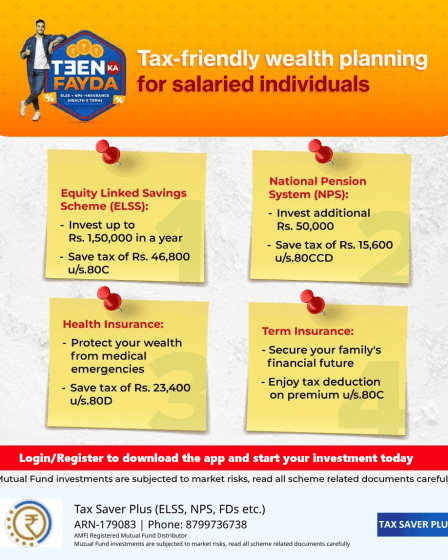

Are you a salaried individual struggling to save taxes? Do NOT miss this! Here are 4 important schemes that not only help you save taxes but also build and protect your financial future. Save taxes up to Rs. 85,800 this financial year. Login/Register on www.taxsaverplus.in to download the app.

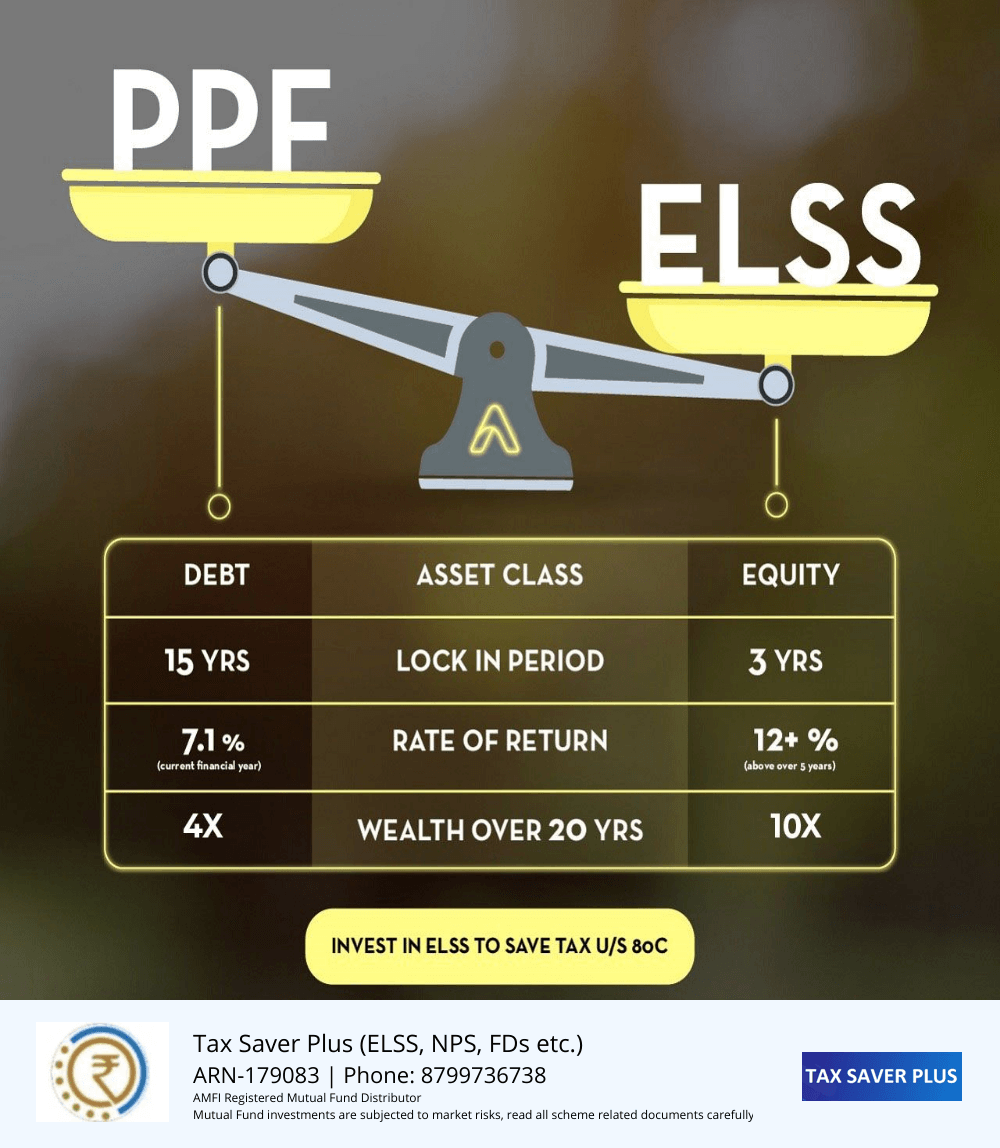

PPF is popular for tax savings, but its 15-year lock-in and meager return of 7% do not win over inflation. This is where ELSS comes in. With the shortest lock-in, and potentially higher returns, it’s a top choice for tax-saving and wealth building. Don’t delay, start your ELSS investment today! Login/Register on www.taxsaverplus.in to download …

Are you seeking the ideal blend of tax efficiency and wealth growth? ELSS could be your answer. To know more, login/register on www.taxsaverplus.in to download the app.

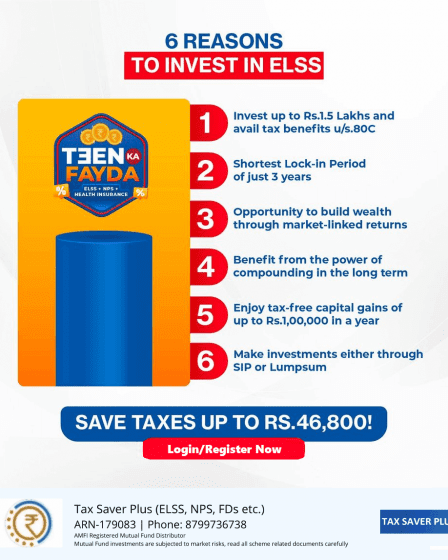

Here are 6 major reasons why you must invest in ELSS. Login/Register on www.taxsaverplus.in to download the app.

Why invest in ELSS instead of other tax savings options?

ELSS stands out as one of the best tax planning tools for 3 reasons: 1.Minimal Lock-in Period: Unlike other options such as 5-year Fixed Deposits (FDs), NSC, insurance, or PPF, ELSS has the shortest lock-in duration of just 3 years 2.Convenient SIP Initiation: ELSS simplifies the process of initiating a SIP, making it an easily …

Adding ELSS (Equity Linked Savings Scheme) to your investment portfolio is like adding fertilizer to your garden – it can accelerate growth and potentially yield greater returns for your wealth over time. Login/Register on www.taxsaverplus.in to download the app.

When comparing Public Provident Fund (PPF) with Equity Linked Savings Scheme (ELSS), PPF offers tax benefits and stability, while ELSS has the potential for higher returns due to its equity exposure, making it a choice for those seeking growth and willing to tolerate some risk. Login/Register on www.taxsaverplus.in to download the app.

Reduce tax burden and increase your wealth through ELSS. Login/Register on www.taxsaverplus.in to download the app.

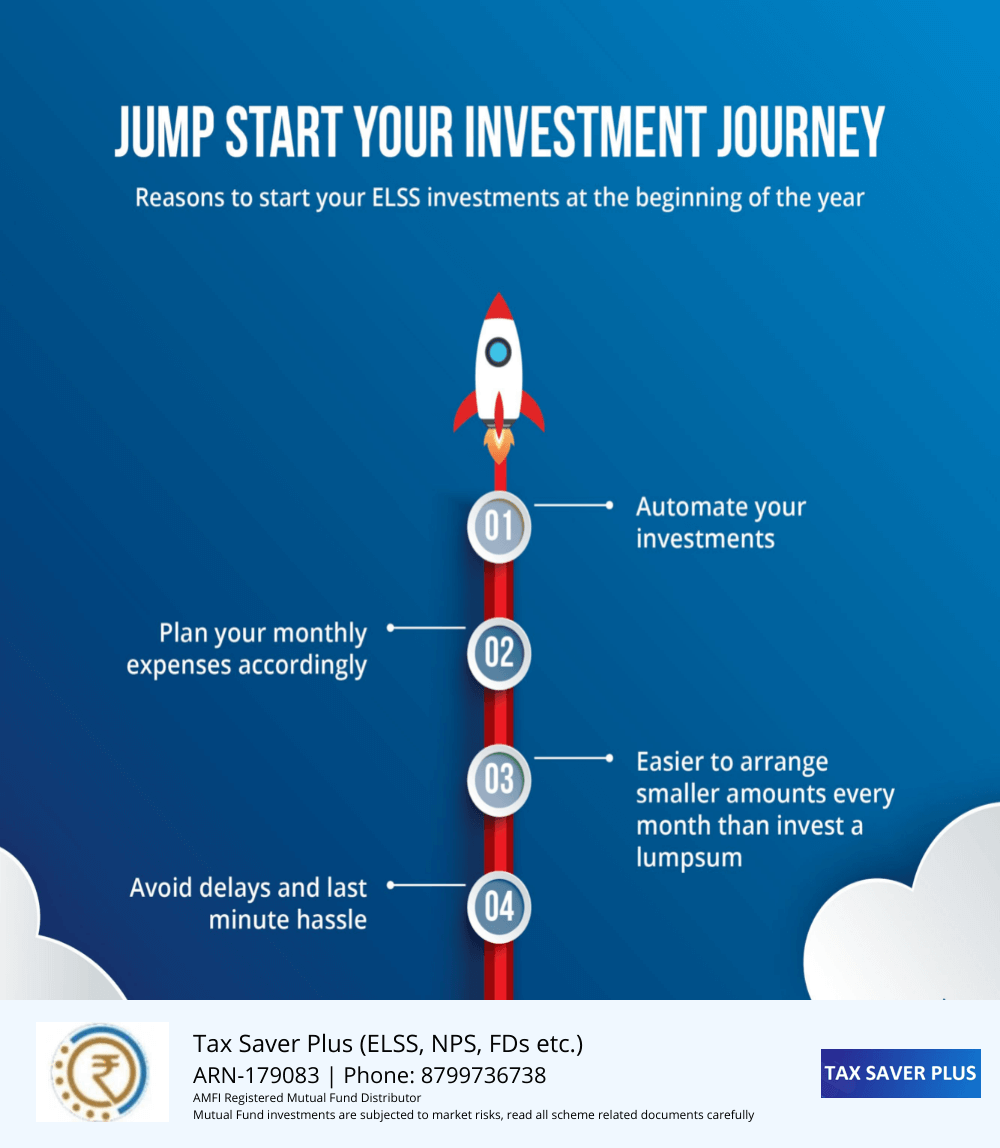

Begin your investment journey with a jumpstart by choosing Equity Linked Savings Scheme. With its potential for higher returns and tax benefits, ELSS can accelerate your wealth growth and set you on a path towards financial prosperity. Login/Register on www.taxsaverplus.in to download the app.