NPS Trio Benefits | Tax Saver Plus All you need is one mantra to achieve the 3 powers of a financially secured retirment life. Login/Register on www.taxsaverplus.in to download the app.

nps

Retirement Planning is like a Matchstick | Tax Saver Plus Retirement is for enjoying a comfortable and relaxed life. ???? Start planning for your retirement in advance and ensure peace of mind during your golden years. ???????? Login/Register on www.taxsaverplus.in to download the app.

This tax-planning season, don’t just save taxes but also build your retirement wealth with NPS. The Save, Invest, Protect ‘SIP’ strategy helps you empower your golden years with smart financial choices. Save taxes up to Rs. 85,800 this financial year. Login/Register on www.taxsaverplus.in to download the app.

In your pursuit to secure today’s riches, don’t forget to protect your post-retirement life. Embrace smart financial planning today: start investing in NPS to accumulate wealth for your future years and also enjoy tax savings. Save taxes up to Rs. 85,800 this financial year. Login/Register on www.taxsaverplus.in to download the app.

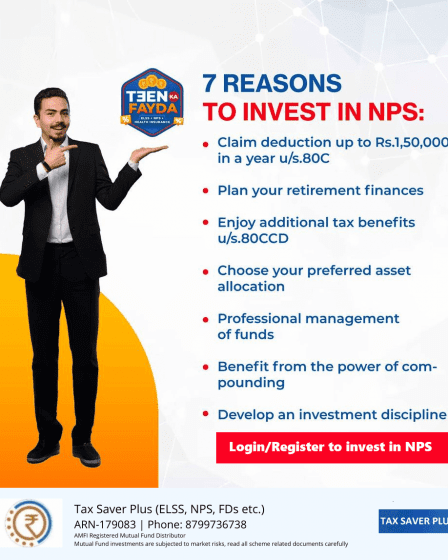

If you have utilised your 80C deduction limit of Rs. 1,50,000, do not worry. With NPS, you can save additional tax of Rs. 15,600 u/s.80CCD(1B) This is your chance to save tax and secure your post-retirement financial goals. Save taxes up to Rs. 85,800 this financial year. Login/Register on www.taxsaverplus.in to download the app.

Do you want a financially secure retirement life? Here are 7 reasons why you must consider investing in NPS: the sought-after tax-saving & retirement planning. Login/Register on www.taxsaverplus.in to download the app.

Secure your golden years through smart retirement planning with the help of expert guidance. Login/Register on www.taxsaverplus.in to download the app.

NPS is a government-backed retirement savings plan in India, designed to provide financial security and stability in your post-retirement years. It’s flexibility, portability, and tax efficiency makes it a popular retirement planning tool. Start planning your retirement today with NPS. Login/Register on www.taxsaverplus.in to download the app.

By investing in a mix of equities, fixed deposits, corporate bonds, liquid funds, and government funds, NPS ensures a stable and substantial post-retirement income. Opting for NPS can be a prudent choice to safeguard your golden years and enjoy a financially secure and comfortable retirement. Login/Register on www.taxsaverplus.in to download the app.