Looking to minimize your taxes and maximize your savings? Consider the “SIP” Strategy: Save up to Rs.85,800 in taxes, Invest smartly in ELSS and NPS, and Protect your wealth with Health Insurance. Login/Register on www.taxsaverplus.in to download the app.

80CCD

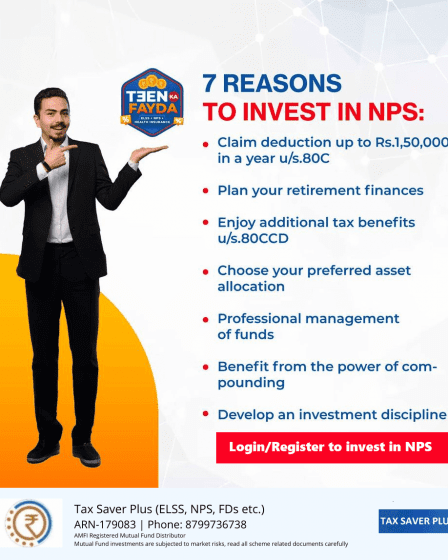

Do you want a financially secure retirement life? Here are 7 reasons why you must consider investing in NPS: the sought-after tax-saving & retirement planning. Login/Register on www.taxsaverplus.in to download the app.

Secure your golden years through smart retirement planning with the help of expert guidance. Login/Register on www.taxsaverplus.in to download the app.

NPS is a government-backed retirement savings plan in India, designed to provide financial security and stability in your post-retirement years. It’s flexibility, portability, and tax efficiency makes it a popular retirement planning tool. Start planning your retirement today with NPS. Login/Register on www.taxsaverplus.in to download the app.

By investing in a mix of equities, fixed deposits, corporate bonds, liquid funds, and government funds, NPS ensures a stable and substantial post-retirement income. Opting for NPS can be a prudent choice to safeguard your golden years and enjoy a financially secure and comfortable retirement. Login/Register on www.taxsaverplus.in to download the app.